OmniPayments and OmniATM are addressing tomorrow’s ATM requirements and already supports one of the largest ATM networks in the world!

The ATM Industry Association US

Conference wrapped up only a few days ago. For OmniPayments this is always an

event where our team is visible as we move among the users as well as check out

the vendors. When it comes to ATMs, the world is changing rapidly as even when

there are societies looking to take cash out of circulation, the presence of a

financial institution “touch point” cannot be ignored or underrated. Today it

may be cash and tomorrow may be tokens or even an automated barrister and

further into the future, the lowly ATM may have successfully morphed into a

fully-functioning branch office that is completely automated.

Automated is the key word here – ATM’s started out simply as automated teller machines providing a “conversation-less” mode to access your cash! Furthermore, the technology exists to turn these machines into anything we want. Walking the exhibition aisles at the ATMIA US Conference, there is a lot of evidence to suggest the lines between kiosks and ATMs, for instance, are becoming very blurred. One thing that is becoming more evident with each conference is that ATMs are bulking-up; it was only a few years ago that one vendor deployed a robotic arm inside the ATM to automate safe deposit boxes. On the other end of the spectrum, there are smaller ATMs to be found in casinos, airport terminals and even legal marijuana dispensaries.

Integration too is yet another word being bandied around when it comes to ATMs. For a number of years the thought here was seamless transaction interfaces – whether the transaction is imitated on a laptop, continues on a mobile phone and then concludes at an ATM, the customer experience should be identical. At no point would the customer be required to start over or drop into a series of menus but rather, the device in use at the time would pick up where previous activity had stopped. While there has been less discussion about this of late for many in the industry this is still a nice-to-have feature that continues to make it into financial institutions RFPs.

Shortly, we will see the emergence of “robots” utilizing deep learning together with AI that will appear before us at exactly the right time when we need cash or equivalents. A little out there, and scary to some financial institutions, but it will occur as we take ATMs to the next level even if such robots are restricted to hotel lobbies, train stations, and government offices, including the DMV! What the ATMIA US Conference is backing is that ATMs may be fifty years old but they aren’t about to go away any time soon even if their physical form morphs to where they become unrecognizable as an ATM of a decade or so ago. What this also brings into focus, however, is the networks ATMs connect to and the ATM software operating behind the scenes.

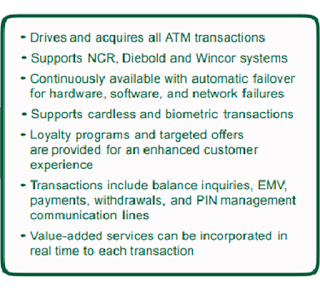

OmniPayments, Inc. has been providing software solutions in support of ATMs and ATM networks for more than twenty five years. “OmniPayments takes your ATM to the next level by leveraging the most up-to-date technologies available. We move where the industry moves, and we grow as our customers do,” according to the OmniPayments web site. Whether your interests lie in biometrics, EMV payments, withdrawals, PIN management or any form of cardless interaction, then OmniPayments can point to financial institutions already using OmniPayments modules to do exactly this:

“OmniATM provides ATM terminal driving

and broad support for the industry’s most popular ATMs. It is intuitive,

user-friendly, feature-rich, and is built on HPE NonStop,” said an OmniPayments

spokesman. “It permits customization of the ATM screen on a per user basis.

OmniPayments adds immense throughput to the mix and offers it all at a

cost-effective price. Plus, with the General Data Protection Regulation (GDPR)

just mere months away (25 MAY 2018), OmniATM is fully compliant with GDPR and

meets every standard industry protocol. OmniATM satisfies all data encryption

requirements.” And don’t be worried about scale as one of the largest banks in

the US already relies on OmniATM to support their network of 14,000 ATMs where,

together with the complementary POS network supported by OmniPayments, a

billion transactions a month are successfully processed.

The ATMIA US Conference may now be over and

attendees may be returning to the offices, but with each event it is hard to

miss just how much attention is being given to ATMs. The major ATM hardware

vendors continue to demonstrate innovative solutions even as the ATM solutions

vendors showcase new features and capabilities being driven by heightened

expectations of financial institutions’ customers. Should any financial institutions

utilizing NonStop systems be thinking about how best to support tomorrows ATM

networks then, by all means, reach out to

OmniPayments. We are only too happy to work with you no matter what you have in

mind – email us or give us a call!

(Reprinted from NonStop Insider digital publication: February, 2018 )

Comments

Post a Comment